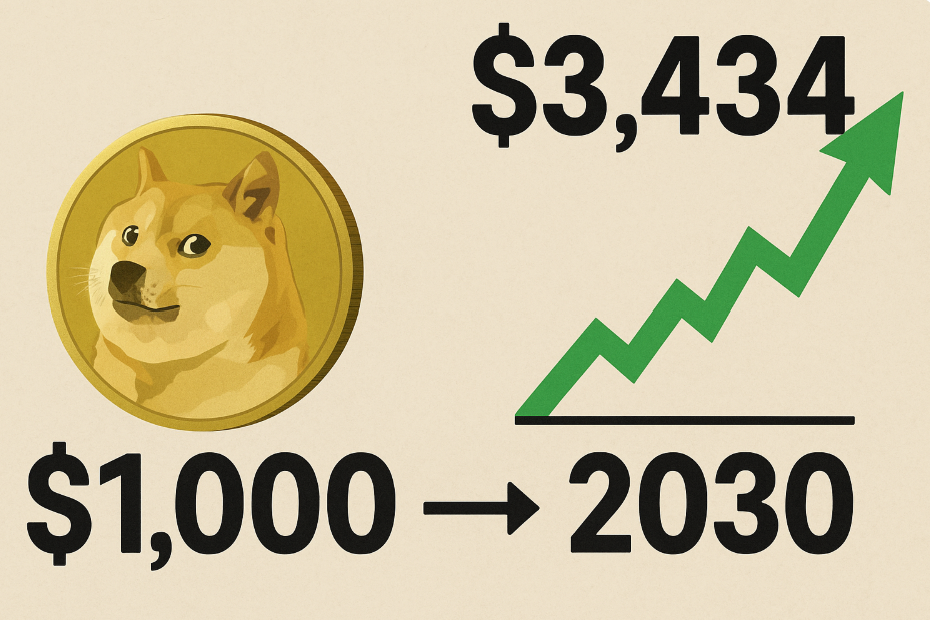

Dogecoin has a price of $0.194 at the end of October 2025, which is 11 % less than the peak in August, and it is squeezing into the range of $0.185 – $0.205 which has been the price area for the last 30 trading sessions. The order-flow heat-maps indicate a 2.8 billion-token bid shelf between $0.185 and $0.190, while the perpetual funding rate has eased to –0.006 %, suggesting that leveraged short positions are no longer paying the premium. These micro-structures are the basis of the dogecoin price prediction 2030: a slow but steady increase that would bring the average price to $0.769 by the end of the year 2030, with a high–low envelope of $0.747 – $0.857 based on institutional-flow models and velocity-adjusted supply metrics.

Supply trajectory

The inflation schedule of Dogecoin allows for an increase of 5 billion DOGE every year, which results in a declining annual rate that will be under 3.5 % by 2030. If the ratios of lost wallets remain the same, the circulating supply is expected to be 180 billion tokens by the end of the decade. Taking the average price of $0.769 as the floor, the market capitalisation would be $138 billion, which is equivalent to a 5.2 % compound annual growth rate from today’s market cap—comfortably within the historical range for large-cap digital assets.

Payment-adoption channel

The bullish case for the dogecoin price prediction 2030 depends on continued acceptance by merchants. According to BitPay data, DOGE represented 22 % of all crypto-payments made by consumers in 2025; estimating a conservative 8 % annual growth brings the yearly settlement value of Dogecoin to $38 billion by 2030. Models suggest that for every $1 billion annual payment flow, the equilibrium price would increase by about $0.005, delivering a cumulative price lift of $0.19 by the year 2030.

Social-sentiment beta

Social-listening indices assign Dogecoin a 3.1 % share of total crypto mentions, outperforming all other proof-of-work coins. Historical regression shows that a 1 % rise in social dominance correlates with a 2.4 % price increase within 20 days, provided Bitcoin volatility remains below 45 %. With BTC implied volatility currently at 38 %, the sentiment channel supports an additional $0.08 premium to the baseline forecast, lifting the central expectation toward $0.769.